At the close of trading on July 15, oil prices continued to fall, natural gas at 1-week low, while gold and platinum were at 1-month high, copper, iron ore, steel, rubber and sugar all increased.

Oil prices continued to fall

Oil prices fell more than $1/barrel, due to expectations that more crude oil will be released to the market after the agreement between leading OPEC producers and the decline in US fuel demand.

At the close of trading on July 15, Brent crude fell $1.29, equivalent to 1.7%, to $73.47/barrel, and West Texas Intermediate crude fell $1.48, equivalent to 2.2%, to $71.65/barrel.

OPEC's monthly report still forecasts a strong recovery in global oil demand for the rest of 2021, while oil demand in 2022 will reach pre-Covid-19 levels.

Natural gas prices remain at 1-week low

Natural gas prices in the US fell to a 1-week low, due to forecasts of higher-than-expected inventories, milder weather and lower air conditioning demand in the next two weeks than previously forecast.

Natural gas futures for August 2021 on the New York Mercantile Exchange fell 4.6 US cents, or 1.3%, to $3.614/mmBTU - the lowest since July 7, 2021. This is the third consecutive decline - the first - since May 2021.

Gold, platinum hit 1-month highs

Gold prices hit a one-month high, boosted by dovish comments from US Federal Reserve Chairman Jerome Powell and concerns about a slowing global economy.

Spot gold on the LBMA rose 0.1% to $1,829.16 an ounce and August 2021 gold futures on the New York Mercantile Exchange rose 0.3% to $1,830 an ounce.

Earlier in the session, gold hit a one-month high after Powell said the US jobs market was "still a long way off" the progress the central bank wants to see before reducing support for the economy.

Bob Haberkorn, senior market strategist at RJO Futures, said gold prices should stay above $1,800 an ounce this week. Concerns about a stock market sell-off also fueled safe-haven buying of bullion.

China's economy grew more slowly than expected in the second quarter of 2021, while weekly US jobless claims hit a 16-month low last week.

Platinum rose 0.6% to $1,135.95 an ounce, after hitting a one-month high.

Copper rose

Copper rose as growth in top consumer China was slower than expected.

Three-month copper on the London Metal Exchange rose 1.2% to $9,455 a tonne.

China's growth in the second quarter of 2021 was weaker than expected, hit by slowing manufacturing activity, higher raw material costs and the Covid-19 outbreak.

Iron ore and steel prices both rise

Iron ore prices in top steelmaker China rose for a fourth straight session as the country's economic recovery slowed, bolstering expectations of additional policy support from the Chinese government.

The September 2021 iron ore futures contract on the Dalian Commodity Exchange rose 1.6% to 1,234 yuan ($191.02) a tonne.

The August 2021 iron ore futures contract on the Singapore Exchange rose 1.9% to $214 a tonne.

China's economy grew at a slower-than-expected 7.9% annual rate in the second quarter of 2021 compared to the second quarter of 2020, due to a slowdown in manufacturing activity. The recovery is expected to be weighed down by rising raw material costs and a new Covid-19 outbreak.

On the Shanghai Futures Exchange, rebar prices rose 0.9%, hot-rolled coil prices rose 0.5%, although China's crude steel output in June 2021 fell 5.6% from a record high in May 2021. Stainless steel prices rose 3.4% to 18,240 yuan/t - the highest since 2019, amid strong domestic demand and low inventories.

Rubber prices rise

Rubber prices in Japan rose after the US Federal Reserve said it would continue to ease monetary policy, boosting commodity prices and other markets.

Rubber futures for December 2021 on the Osaka Exchange rose 4.4 yen, or 2.1%, to 213.9 yen/kg.

Meanwhile, the price of rubber futures for September 2021 on the Shanghai Futures Exchange increased by 1.4% to 13,370 CNY/ton.

Coffee prices increased in Vietnam and New York, decreased in Indonesia and London

Coffee prices in Vietnam's domestic market increased due to tight supply at the end of the harvest season and a shortage of export goods in the past 7 months.

Vietnam's export price of robusta coffee (type 2, 5% black & broken) had a discount of 80-90 USD/ton for the September 2021 futures contract on the London Futures Exchange compared to a discount of 60-100 USD/ton a week ago. In the domestic market, green coffee beans were sold at 37,000-37,200 VND (1.61-1.62 USD)/kg, up from 34,600-35,500 VND/kg a week ago.

Traders said a shortage of shipping containers has pushed freight rates at least three times higher than before the pandemic, also contributing to the price increase.

In Indonesia, grade 4 robusta (80 defective beans) coffee was offered at a premium of $20-30 a tonne for the August-September 2021 contract, down from a premium of $30-50 a tonne for the August 2021 contract a week ago.

In New York, arabica coffee futures for September 2021 rose 0.45 US cents, or 0.3%, to $1.5705 a lb.

In London, robusta coffee futures for September 2021 fell $6, or 0.3%, to $1,756 a tonne, after hitting a 2-1/2-year high on Monday (July 13, 2021).

Sugar prices rise

Raw sugar prices rise from two-week low.

October 2021 raw sugar futures on the ICE Futures Exchange rose 0.4 US cents, or 2.4%, to 17.33 US cents/lb, after hitting a two-week low of 16.73 US cents/lb on July 14, 2021.

At the same time, August 2021 white sugar futures on the London Futures Exchange rose $10.70, or 2.5%, to $436/tonne.

Wheat prices rise, soybeans and corn fall

Wheat prices in the US rose to an 8-1/2-year high of nearly $9/bushel, as drought threatened crop growth in the northern Plains and Prairies of Canada.

On the Chicago Board of Trade, September 2021 wheat futures rose 17-3/4 US cents to $6.72 a bushel and September 2021 spring wheat futures rose 21-1/4 US cents to $8.94 a bushel, having hit $8.95-1/2 a bushel during the session – the highest since December 2012. August 2021 soybean futures fell 5-1/2 US cents to $14.47-1/2 a bushel and November 2021 soybean futures fell 3-1/4 US cents to $13.80 a bushel. December 2021 corn futures fell 2-1/2 US cents to $5.56-1/4 a bushel.

Rice prices in India hit 16-month low, Thailand at 1.5-year low, Vietnam at 1-year low

Indian rice export prices hit a near 16-month low as new crop supplies hit the market and demand remained low, but coronavirus restrictions in Vietnam have dented sales in the key market.

In top rice exporter India, 5% broken rice prices fell to $364-$368 a tonne from $367-$371 a week ago.

For 5% broken rice, Vietnamese rice prices were unchanged from a week ago ($465-$470 a tonne) – the lowest since July 2020.

In Thailand, benchmark 5% broken rice prices fell to their lowest since December 2019 at $405-$412 a tonne from $410-$425 a tonne the previous week, as the Thai baht weakened against the US dollar, reducing rice export prices.

Thailand exported 1.78 million tonnes of rice in the first five months of 2021, down 31% from the same period last year.

Palm oil prices hit 6-week high

Palm oil prices rose more than 3% to a six-week high, as higher exports since the start of the month, along with dry weather and a labor shortage affecting global vegetable oil production, also boosted the market trend.

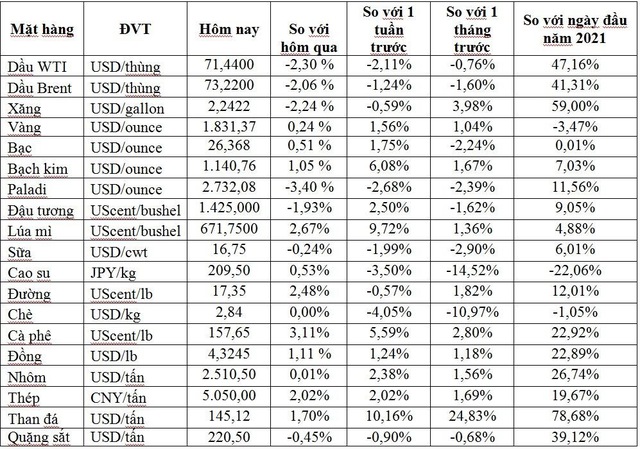

Palm oil futures for September 2021 on the Bursa Malaysia exchange rose 136 ringgit, or 3.38%, to 4,157 ringgit ($989.53) a tonne. Palm oil prices rose for the third consecutive session to their highest level since June 3, 2021. Prices of some key commodities on the morning of July 16:

According to CafeF.vn